179 Tax Law Deduction

If you're ready to purchase a commercial vehicle at Fred Haas Nissan, you should be able to get a discount through Section 179. At the moment, the maximum deduction is $25,000 in addition to adjustment for inflation. As a result, businesses like yours near Tomball can deduct the full cost of qualifying equipment from their taxes, up to $25,000, though vehicles have to meet guidelines like 6,500 lb. minimum GVWR, cargo dimensions, and other requirements.

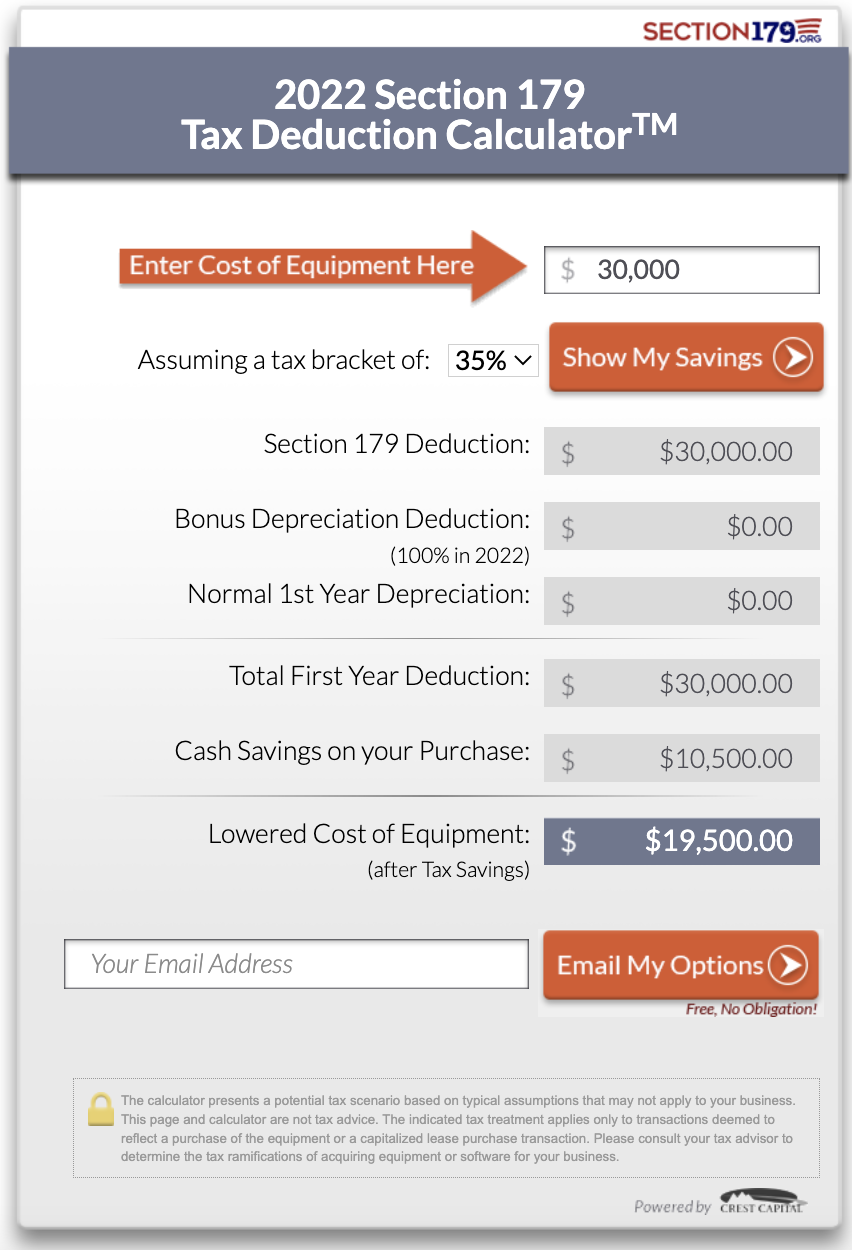

This tax deduction should help businesses here as long as the vehicles total under $200,000. For example, a $37,000 Nissan NV Cargo Van purchase would receive a cash savings on purchase of over $10,000++ (assuming a 35% Tax Bracket and utilizing the $25,000 deduction plus normal first year depreciation of $5,000). Ready to save on your next commercial vehicle purchase at Fred Haas Nissan? Calculate your savings at the link below!